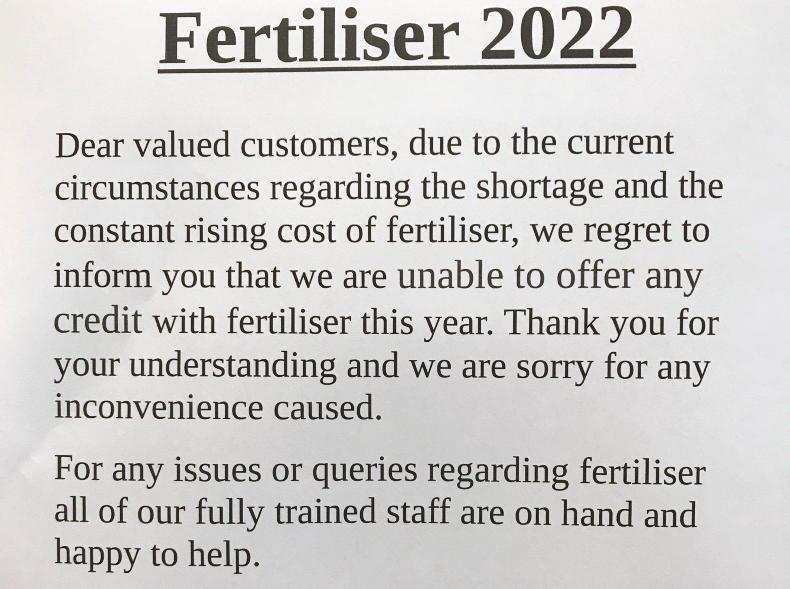

LAST week a poster appeared in my local agri-store that many may have noticed appear in their own local store too. Despite the European Commission recently dispelling concerns over fertiliser supplies being tight this year, many of us are nervous about the threat of high prices and low supplies and the knock-on effect on grass and fodder growth or supply.

Russia is the largest fertiliser exporter in the world and also supplies 40% of Europe’s natural gas. The combination of conflict and economic sanctions could push both gas and fertiliser prices higher in the weeks and months ahead.

Senator Tim Lombard recently raised the question of a fodder crisis similar to the one in 2018 at the joint Oireachtas committee. Lombard predicts a 20% fall in fertiliser usage in Ireland in 2022 connected to the soaring costs of urea, potash and gas.

With lower amounts of fertiliser available, he raised the point of the negative effect this could have on production of fodder for livestock including horses. Horse Sense took a closer look at the factors impacting fertiliser supplies in Ireland for spring.

Essentially, global trade is showing signs that prices of fertiliser and its components are actually falling again. However, recent trade has been very limited as buyers are holding off to see if prices fall further. The correction has not fed through to Irish prices as yet.

The international urea market remains very volatile. Growing tensions between Russia and Ukraine have the potential to tighten both fertiliser and grain prices. Natural gas prices (main ingredient in nitrogen fertiliser) remain volatile and are edging upwards in recent days. With Russia being the largest fertiliser exporter any imposed sanctions may impede their ability to export. Same for grain and in addition any conflict may disrupt sowings and exports from Ukraine.

In terms of credit for fertiliser, experts advise it may be a year that farmers need to approach their bank or credit union for working capital. This could be a cheaper option than merchant credit. Ideas for alternatives to popular fertilisers are offered on the Teagasc website, including expert advice on maximising both organic and chemical fertiliser.

The current facts:

While global urea prices have fallen roughly 14% since their peak in November, they are still over 50% higher than prices at the start of September 2021 ($456/tonne). International urea prices have fallen sharply since mid-December giving rise to hopes that a market correction may be underway. However, prices remains 55% higher than September 2021.

Granular urea in the Middle East is currently trading at $804/ tonne down 6% since the start of January. Urea market prices peaked in mid-November at approximately $935 /tonne. As prices declined from the start of the year, buyers are said to be staying out of the market unwilling to trade product until there is signs of price stability. The US wholesale urea market is also highly volatile with some reports of prices at levels of last September reflecting the bearish sentiment in the market. However, farm gate prices for urea in the US are trading at approximately the equivalent of €817 / tonne similar to mid-December price levels. This is roughly 15% below current Irish prices.

Potash prices are more stable, influenced by economic sanctions hitting Belarus which accounts for 20% of global potash exports. Gas prices, which fell from their peak in December 2021 are now trading upwards as volatility persists in the market. Natural gas is the key ingredient in the manufacture of nitrogen fertiliser accounting for 80% of the costs. The growing political crisis between Russia and Ukraine is hanging over commodity markets.

This is a subscriber-only article

This is a subscriber-only article

It looks like you're browsing in private mode

It looks like you're browsing in private mode

SHARING OPTIONS: