SOME major betting companies have warned they may reduce their racing sponsorships and racing-related special offers for customers following this week’s Budget speech by Chancellor Rachel Reeves.

Although the Labour government did not, as feared, increase betting duty on racing, there will be higher taxes on other forms of gambling which, the bookmakers say, will force them to cut costs in order to protect profits.

Tax on the profits made from horse racing bets, both in shops and online, will remain unchanged at 15%, news which comes following a campaign against the idea of harmonising gambling duties.

Such had been the concerns within the British racing industry of the impact of gambling tax rises that an unprecedented day of strike action was held on September 10th. The scheduled meetings at Carlisle, Lingfield, Kempton and Uttoxeter were all cancelled, while many of the sport’s leading figures gathered at Westminster for the British Horseracing Authority-led ‘Axe The Racing Tax’ event.

Economic analysis commissioned by the BHA suggested a rise from 15% to 21%, the current rate of remote gaming duty, could cost the sport at least £66 million and put 2,752 jobs at risk in the first year, in what BHA chair Lord Allen termed “nothing short of an existential threat for our sport”.

That threat is now lifted with confirmation duty will not be adjusted, but the government does expect to raise over £1 billion by 2031 through changes to other gambling taxes.

General betting duty, paid on other forms of sports betting, will remain at 15% in betting shops, but will rise to 25% online, while remote gaming duty, paid on online casino betting, will rise from 21 to 40%.

Machine betting duty, paid on land-based betting terminals such as those in betting shops, has not been adjusted.

Bookmakers had warned ahead of the Budget that any changes impacting their profits could have a knock-on effect for racing, with the potential for less generous odds and betting shop closures. British racing receives income through media rights payments and the levy from every shop.

In announcing the rises, the Chancellor said: “Remote gaming is associated with the highest levels of harm and so I am increasing remote gaming duty from 21% to 40%, with duty on online betting increasing from 15% to 25%.

“I am making no change to the taxes on in-person gambling or horse racing and I am abolishing bingo duty entirely from April 2026. Taken together, my reforms to gambling tax will raise over £1 billion per year by 2031.”

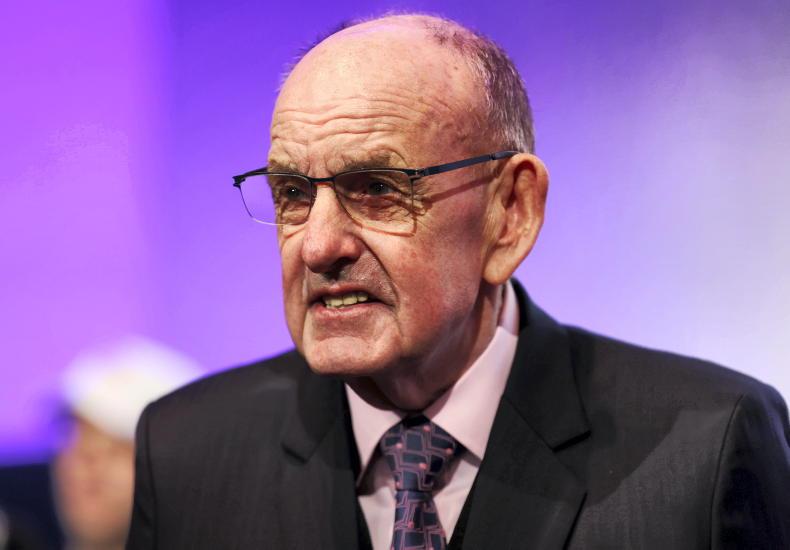

Kevin Harrington, Flutter’s UK and Ireland chief executive, said the tax increases were “a very disappointing outcome and will have a significant adverse impact on our industry”.

He added: “The Chancellor rightly wants to address harm, but these changes will hand a big win to illegal, unlicensed gambling operators who will become more competitive overnight. These black market operators don’t pay tax and don’t invest in safer gambling. At 40%, the UK’s remote gaming duty is now above countries such as the Netherlands, where a recent tax increase saw a rise in illegal gambling and a fall in government receipts.

He added that “through both our scale and leading position in the UK, as well as the proactive cost initiatives that we are taking” the firm is “well placed to navigate” the changes.

Some gambling stocks suffered hefty share price falls on the London market yesterday after the tax blow, with William Hill owner Evoke sliding 18%.

This is a subscriber-only article

This is a subscriber-only article

It looks like you're browsing in private mode

It looks like you're browsing in private mode

SHARING OPTIONS: